Scan this article:

Spoiler alert: younger Aussies are showing no signs of slowing down their investing in 2023.

Last month, we surveyed more than 1,400 Superhero investors to understand the shifts in their investing habits over the past financial year. As inflation and interest rates continue to influence Aussies’ spending habits, we were eager to uncover the trends shaping the investing landscape.

- Have economic factors influenced Aussies’ investment choices?

- Are Aussies investing more or less?

- Do they monitor their portfolios more closely?

- And most intriguingly, what stocks or strategies are they eyeing?

The answers? It all depends on which demographic you ask.

Here are the top seven investing trends we uncovered.

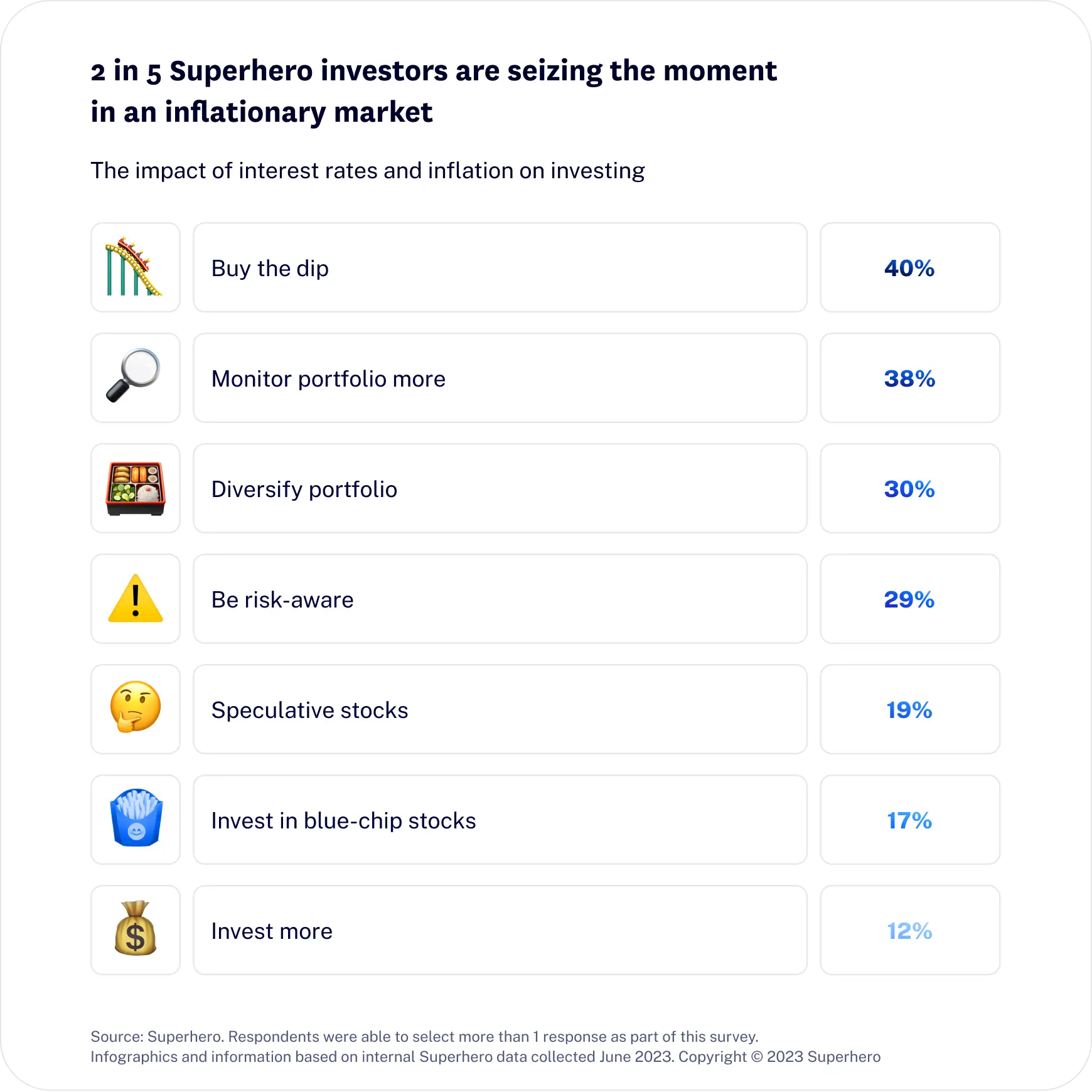

#1. Buy the dip

To the average person, investing in an inflationary market can seem counterintuitive.

But 40% of savvy Superhero investors see it as an opportunity to make strategic moves, like “buy the dip”. In other words, attempting to acquire quality investments at a discounted price.

While “buy the dip” isn’t exactly a new investing concept, we’ve seen massive shifts in the behaviours of investors on our platform in recent months.

As Warren Buffett famously said, “Whether we’re talking about socks or stocks, I like buying quality merchandise when it is marked down.”

In fact, some of the most popular stocks for the year have been Qantas (QAN), Core Lithium (CXO) and Tesla (TSLA) which have all seen a drop and subsequent bounce back.

If you can keep a close eye on market fluctuations, why not be ready to pounce on discounted stocks when the time is right?

| 🔥 Hot tip: Check out ‘Today’s Fallers’ under the Categories section in our Invest tab to spot the big dippers at the end of each trading session (weekdays at 4pm for Aussie stocks and 10am for U.S. stocks). |

#2 Monitor your portfolio more often

Are you watching your portfolio like a hawk right now?

When asked how the current economic climate had impacted their investing habits, 38% of investors said they were checking their portfolios more frequently.

Interestingly, our female-identifying Superheroes were the most likely demographic to keep a close eye on their portfolios.

Question is, why is that?

Our data shows that female investors tend to be more risk-averse than their male counterparts.

But that’s not to say women aren’t crushing their financial goals, as our data also showed that women are more likely to have made a new financial year resolution.

And a recent ASX Australian Investor Study found that 42% of Aussie investors are now women — with a median portfolio of over $95K!

#3 Diversify

Diversification isn’t just a strategic shield against investment risks.

It’s a pathway to spreading your investment wings across multiple asset classes, sectors and markets.

But with the current economic conditions presenting uncertainties and fluctuations, diversification has become more crucial than ever.

The allure of diversification has not gone unnoticed among Superheroes. 30% of investors said they were eagerly looking to diversify their portfolios in FY24. And 3 out of 4 investors said they were looking to invest in an Aussie ETF.

But investment preferences for diversification varied significantly across different age groups.

For those aged 25-34, the allure of property, bonds and cryptocurrencies reigned supreme.

On the other hand, customers aged 55 and over preferred international ETFs and precious metals.

#4 Be risk-aware

Caution and capital preservation are top priorities in FY24.

While investing can be thrilling, many Superhero investors are opting to play it safe in an inflationary environment.

However, a cautious approach to investment doesn’t mean settling for stagnant returns.

As our Head of Strategy, Rachel Hopping, put it:

|

Rather than chasing high-risk, high-reward ventures, 29% of investors are seeking steadier, long-term options with lower risk.

Which brings us to our next trend…

#5 Speculative stocks

…on the opposite end of the spectrum.

19% of Superhero investors are still thriving on the thrill of speculative stocks.

Interestingly, it seems many investors still believe in the transformative power of emerging technologies and industries — and they’re not afraid to embrace risk in search of “the next big thing”.

Some patterns are emerging on our platform to back this up. We’ve seen a growing interest in investments in sectors like artificial intelligence (AI), rare earths and meme stocks — to name a few. In fact, AI and robotics caught the attention of 44% of investors for the latter half of the calendar year.

| 🔥 Hot tip: Follow stocks you have your eye on by tapping the star in the top right-hand corner of our app — and be sure to check out their latest financial reports under ‘News’. |

#6 Invest in blue-chip stocks

Stability is the name of the game, and Superhero investors know it well.

While many are eyeing the next big thing, others are placing their bets on more established, financially sound companies with a history of steady growth and dividends.

In FY24, many investors are putting their faith in blue-chip stocks. Some examples include Apple (AAPL), Microsoft (MSFT) and BHP Group (BHP). Be sure to browse our Blue Chip category for more stocks.

Those classics never go out of style.

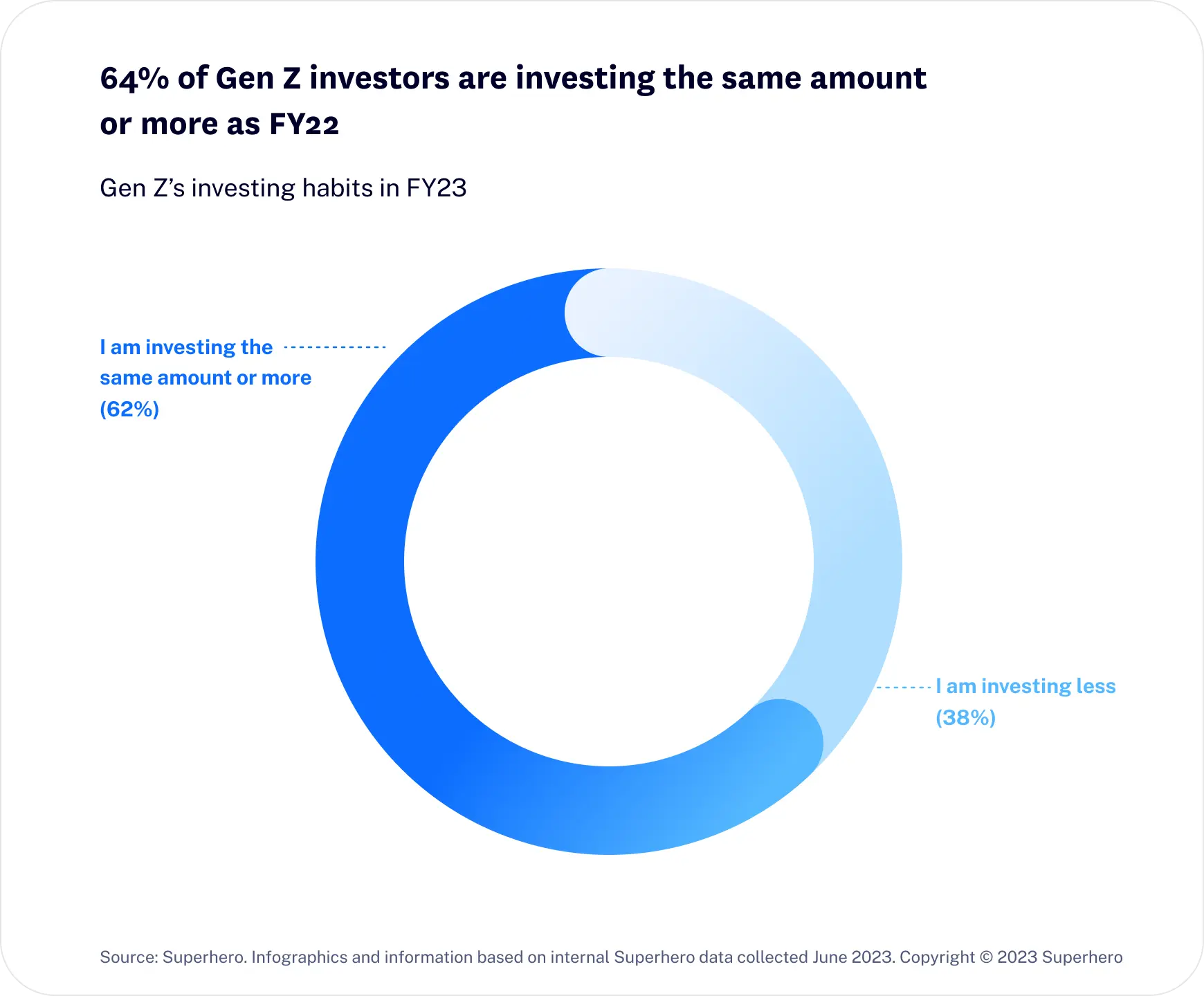

#7 Invest… more

Did someone say young people lack financial discipline? Not our Gen Z investors! Almost 62% of Gen Z investors are committed to their financial journey, investing the same amount or more as in FY22.

Why? Many are jumping into the stock market with enthusiasm because their savings accounts just aren’t cutting it.

Inflation not only makes the weekly shop costlier but also erodes the value of hard-earned cash.

👉 Consider this: If someone thinks they’re earning a secure 5% interest on their savings balance, but inflation stands at 7%, they’re actually losing 2% of their wealth each year.

As a historical reference, over the last 20 years, the ASX has shown an average return of around 8% per annum.

What’s the takeaway?

In the investing world, uncertainty and opportunity collide.

But guess what? Superheroes ride that roller coaster without fear.

In an inflationary market, investors are becoming more engaged with their finances and focusing more on conventional investing wisdom, depending on the stage of life they’re at.

With knowledge, opportunity and accessible investing options at their side, Superheroes fearlessly navigate the ever-changing markets.

Disclaimer: The content in this blog is for informational purposes only and does not constitute financial advice. Please consult a financial advisor before making any investment decisions.

Become a part of

our investor community

Why you should join us:

- Join free and invest with no monthly account fees.

- Fund your account in real time with PayID.

- Get investing with brokerage from $2. Other fees may apply for U.S. shares.

Read our latest articles

Make knowledge your superpower and up your skills and know-how with our news, educational tools and resources.

![The top ASX lithium stocks by trade volume and performance [2023]](https://www.superhero.com.au/wp-content/uploads/2023/06/24-03_blog_news_toplithiumstocks_hero@2x-1024x796.jpg)