Scan this article:

Markets don’t just move because of numbers on a screen. They move because of what’s going on in the world.

In 2026, geopolitics is top of the list of what is moving markets. Trade disputes, elections, military action and tech rivalry are all nudging share prices, currencies and commodities. You don’t need to be glued to the news to notice either. It usually shows up as a bit more chop in markets, the odd sharp move or a sudden change in mood.

And a lot of the time, it starts in the US.

That’s why the first risk to watch in 2026 is political uncertainty in the United States.

1. Political uncertainty in the United States

The US sits at the centre of global markets, so when its politics get unpredictable, the effects tend to travel fast.

In early 2026, proposed tariffs of 10-25% on several European countries over Greenland highlighted just how quickly trade policy can shift. Markets reacted almost immediately. Share markets wobbled, the US dollar weakened and gold prices moved higher.

What investors should know:

Sudden policy changes increase uncertainty. Markets generally don’t like uncertainty, which often shows up as higher volatility and a move towards assets seen as safer.

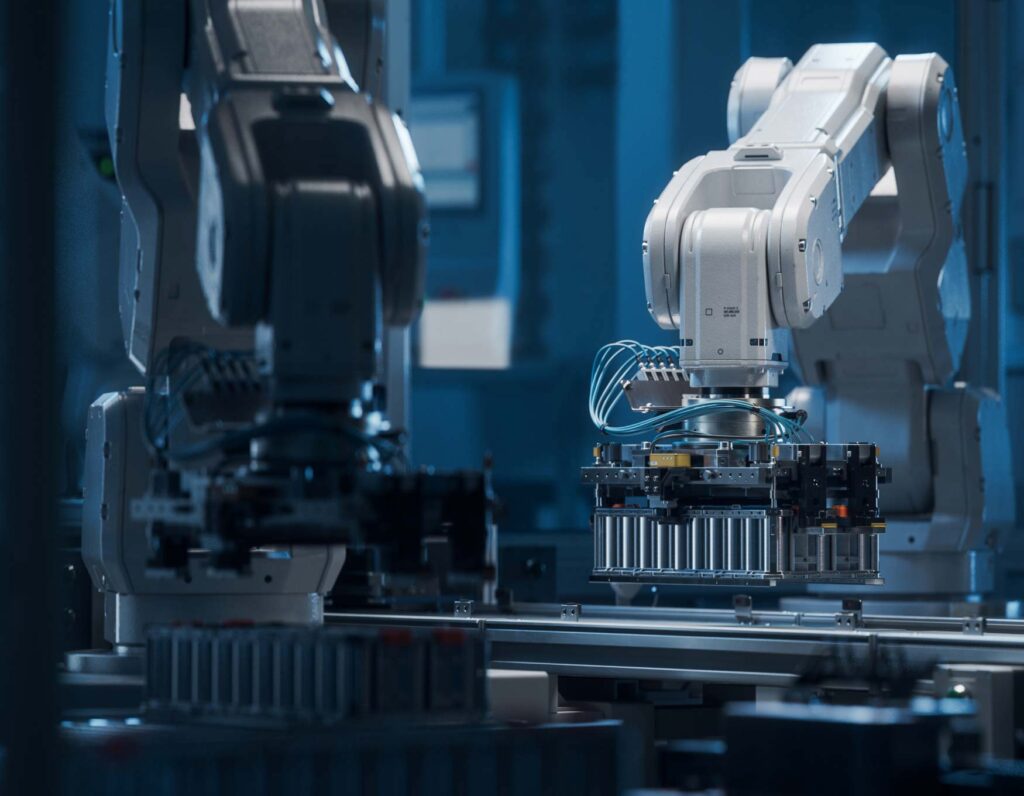

2. The global technology arms race

The competition between the US and China isn’t just about who builds the best tech. It’s about who controls AI, semiconductors, batteries, critical minerals and who gets access to them.

Governments are deeply involved, using subsidies, export controls and restrictions to protect strategic advantages.

Why it matters for markets:

When governments shape outcomes, company valuations can shift quickly. Entire sectors can be re-priced based on policy decisions, not just earnings.

3. Rising tensions in the Americas

US intervention in Venezuela in early 2026, including the capture of Nicolás Maduro, sent shockwaves through energy markets. Political and military responses from neighbouring countries added to the uncertainty.

Oil prices jumped, while demand for gold picked up as investors reassessed regional risk.

Why it matters for markets:

Geopolitical shocks often hit commodities first. Moves in oil and metals can then flow through to inflation expectations and broader markets.

4. Europe’s political fatigue

Europe continues to face internal political strain while also being exposed to decisions made elsewhere. Tariff threats linked to Greenland showed how vulnerable European economies can be to external pressure.

That combination has weighed on confidence across the region.

Why it matters for markets:

When regions appear less stable or less united, investors tend to demand a higher risk premium, which can weigh on share prices, bonds and currencies.

5. Russia’s ongoing hybrid conflict

The Russia – Ukraine war hasn’t gone away, even when it drops out of daily headlines. Military activity near NATO borders and threats to European energy infrastructure continue to keep risk elevated.

Markets remain sensitive to any sign of escalation.

Why it matters for markets:

Long running conflicts can quietly support higher energy prices and benefit sectors like defence and cybersecurity, even without dramatic news.

6. Governments picking winners and losers

Governments are playing a bigger role in shaping economies. Industrial policy, subsidies and trade barriers are increasingly common, particularly as the US and China pull further apart economically.

This is changing how capital moves around the world.

Why it matters for markets:

Policy support can help some industries outperform while others struggle. Markets don’t always rise or fall together, and those gaps are becoming more noticeable.

7. China’s economic slowdown

China entered 2026 dealing with slower growth and deflationary pressure. Given China’s role as a major consumer of raw materials, this matters well beyond its borders.

It also intersects with technology competition and global trade policy.

Why it matters for markets:

Weaker growth in China can weigh on commodity prices and emerging markets, with flow-on effects for global inflation and trade.

8. AI as a geopolitical issue

AI is no longer just a tech story. It’s a strategic asset, and governments are stepping in to regulate, protect and compete over it.

That adds another layer of uncertainty to parts of the market that are already priced for high growth.

Why it matters for markets:

When expectations are high, even small changes in regulation or costs can trigger sharp moves, particularly in tech-heavy sectors.

9. Trade uncertainty

Trade tensions within North America, combined with renewed transatlantic disputes like the Greenland tariff threats, continue to disrupt supply chains.

Industries such as autos, steel and manufacturing are especially exposed.

Why it matters for markets:

Trade uncertainty often leads to sector specific volatility rather than broad market sell-offs. Some industries simply feel it more than others.

10. Resource scarcity

Resource pressure is becoming a bigger geopolitical issue. Water stress is rising globally, while unrest in regions like Iran continues to affect energy supply expectations and regional risk pricing.

These pressures tend to build gradually, rather than explode overnight.

Why it matters for markets:

Long-term resource constraints can increase the strategic value of certain assets, while also raising risk in vulnerable regions.

When risks overlap

Investing has always involved uncertainty. With today’s crop of global leaders, policy direction can shift within weeks, turning yesterday’s headline risk into tomorrow’s market driver. Beyond the top 10, investors are also watching the potential for an oil supply shock out of Iran, escalating tensions across the Taiwan Strait, renewed conflict between Russia and NATO, or even questions about NATO’s future itself if U.S. foreign policy takes another turn.

The Superhero takeaway? You don’t need to predict geopolitics to understand markets. But knowing how these forces influence prices can make market moves feel less random and a lot less intimidating.

The pace of change may be relentless, but clarity doesn’t have to be.

Disclaimer : The opinions expressed in this article are those of the author and do not necessarily reflect the views of Superhero Securities Limited(ABN 96160456315)(AFSL No.430150 )or its affiliates.

Superhero Markets Pty Ltd (ABN 36 633 254 261) is a Corporate Authorised Representative (CAR 1276309) of Superhero Securities Limited (ABN 96 160 456 315) (AFSL 430150).

Please read and understand our Financial Services Guides, Terms & Conditions, Privacy Policy and Website Terms of Use at superhero.com.au/support/documents, before deciding to use or invest on Superhero. We do not provide financial advice that takes into consideration your personal objectives, financial situation or particular needs. All investments carry risk, so please consider carefully before making any investment decisions and seek independent financial advice. Past performance is not indicative of future performance. Pictures, charts and graphs are provided for illustrative purposes only.

Copyright © 2026 Superhero

Become a part of

our investor community

Why you should join us:

- Join free and invest with no monthly account fees.

- Fund your account in real time with PayID.

- Get investing with brokerage from $2. Other fees may apply for U.S. shares.

Read our latest articles

Make knowledge your superpower and up your skills and know-how with our news, educational tools and resources.

![The top ASX lithium stocks by trade volume and performance [2023]](https://www.superhero.com.au/wp-content/uploads/2023/06/24-03_blog_news_toplithiumstocks_hero@2x-1024x796.jpg)