Scan this article:

Two months ago, we talked about Singular Health (ASX:SHG) as a microcap with a US$19 billion annual recurring revenue opportunity in U.S. healthcare. We highlighted its flagship 3DICOM™ platform, the potential to cut billions in waste from duplicate scans and the unique scalability of the Managed Service Organisation (MSO) model.

But what we didn’t dive into as much was SHG’s partner: Provider Network Solutions (PNS). In a rare move, PNS isn’t just SHG’s first major U.S. customer – it’s also a shareholder. PNS has invested in SHG twice already and has indicated it would consider backing the company further.

For investors, that raises an important question: what does it mean when your first U.S. partner is also putting capital on the table?

Let’s take a closer look.

Why PNS is backing Singular Health

For early stage medtechs, two questions matter most: does the tech work and will customers pay for it? PNS has already answered both.

- Proven technology: SHG’s proof-of-concept deployments showed that 3DICOM™ could connect disparate PACS systems and effectively and safely share DICOM images and reports while also running AI models on the images in transit. That success convinced PNS to take a 2% equity stake in SHG earlier this year.

- Commercial momentum: On the back of that success, SHG signed a US$1.3m pilot contract in June, covering 1,000 licences at US$800 each (US$800k ARR) plus US$500k in development fees.

- Growth potential: With over 1 million practising physicians in the U.S., the total addressable market for 3DICOM™ is estimated at US$19b in annual recurring revenue.

- Skin in the game: By investing not once but twice, PNS has aligned its financial interests directly with SHG’s success – a rare and powerful signal of conviction.

What PNS gets out of the deal

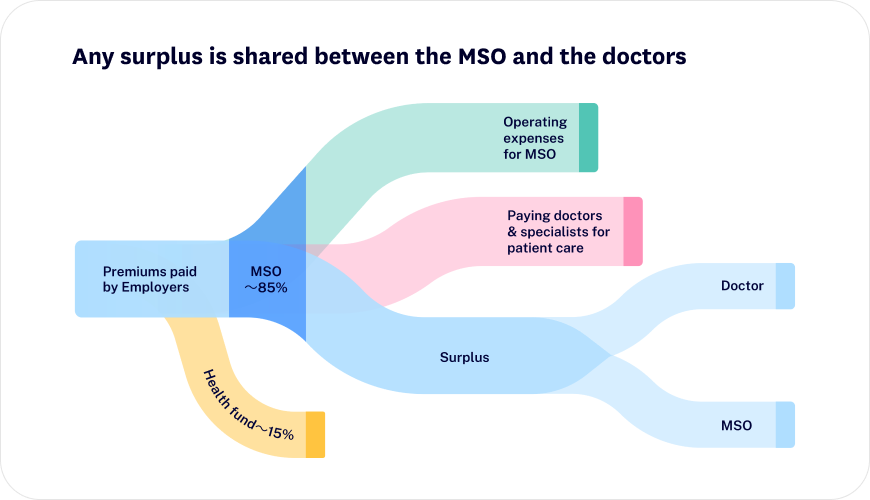

To see why PNS is leaning in, it helps to understand the MSO business model.

In the U.S., healthcare isn’t centrally managed. Doctors often run independent practices but rely on MSOs to handle administration, billing, IT and compliance. MSOs also introduce new technologies to their networks.

Here’s how it works for PNS:

- Premiums in: Employers pay health funds insurance premiums. Roughly 85% goes into a pooled fund managed by the MSO.

- Allocations: The MSO uses the pooled fund to deliver care through the network of doctors and specialists.

- If care isn’t used: The MSO keeps the portion and then distributes it across the providers who have contributed to create that surplus.

- If care is used efficiently: Lower costs mean more savings left in the pool. These savings are shared between MSO and doctors, typically 50/50, sometimes 60/40 or 70/30.

The incentive is clear: lower costs = higher profits. By reducing duplicate imaging and improving efficiency, SHG’s 3DICOM™ grows the savings pool – which means higher returns for both doctors and MSOs like PNS.

Beyond the dollars, PNS also benefits from:

- Better patient outcomes: faster diagnoses and treatment intervention, fewer redundant scans.

- Higher satisfaction for patients and physicians: smoother workflows and less admin burden improve the overall care experience. For MSOs and health plans, this translates into stronger STAR ratings, which directly impact reimbursement levels and competitiveness in attracting members.

- Competitive differentiation: positioning itself as a forward-looking MSO in a US$46.8b market growing ~13% a year.

In Puerto Rico alone, PNS manages around 50,000 members. Across its full network, the MSO covers 3.7 million patients and 3,500 practitioners. That means the pilot isn’t just a test run – it’s a foothold into a system with national reach.

This is the MSO multiplier effect in action. By partnering with one MSO, SHG bypasses the need to sell clinic by clinic. A single agreement can cascade across hundreds of practices. Scale that up – US$800 per licence across tens of thousands of doctors linked to PNS and potentially other MSOs – and the opportunity stretches toward SHG’s estimated US$19b ARR market.

What’s next: beyond the pilot

The pilot is already gaining traction. 250 of the 1,000 contracted licences are deployed, just weeks into rollout – a tangible sign of execution.

From here, several growth channels could unfold:

- National health funds: PNS is in talks with two major U.S.-wide payers, opening the door to even broader distribution if those partnerships take shape.

- Government appetite: SHG is also introducing 3DICOM™ into U.S. federal healthcare projects, where reducing waste is a top priority. With US$30b lost annually to duplicate and unnecessary scans, the economic case is compelling.

- Future MSO opportunities: The MSO model itself creates a built-in incentive for expansion. Both SHG and PNS have reason to consider additional MSO partnerships over time, each of which could represent a step-change in scale. The uptake of the SHG solution by health fund payers will also expand the uptake by MSO’s under such health funds.

What this means for investors

For investors, the SHG-PNS partnership provides three clear takeaways:

- Validation: A major U.S. healthcare operator has not only signed a contract but also invested in SHG – twice.

- Execution: The PNS pilot is live, with 250 licences already deployed. Early adoption is proof that SHG can deliver.

- Scale: The MSO and Health Plan model turns one deal into many clinics, offering leverage into a US$19b ARR opportunity.

Financially, SHG is debt free with A$13m cash following its recent raise, giving it breathing room to expand. Management has guided toward a clear pathway to US$30m in annual revenue by 2026 through the PNS direct partnership network and joint venture network alone including HOPCO, but also via the existing relationships with health plans.

For a microcap, those milestones – validation, execution and a credible scale path – are rare.

Risks & watchpoints

As with any early-stage company, there are risks to watch:

- Execution risk: Scaling across different states with unique regulations is complex.

- Customer concentration: PNS is currently the only major commercial partner. While SHG is exploring further partnerships, none have been confirmed yet.

- Competitive landscape: Larger healthcare IT vendors may respond if SHG gains traction.

- Capital requirements & share dilution: While well-funded today, rapid growth could require further raises which could dilute existing shareholdings.

- Timing: SaaS revenues take time to build.

An evolving story of success

Two months ago, we introduced SHG’s vision, its US$19b opportunity and its first major commercial partnership. Today, that story has moved forward: a live pilot with 250 licences deployed and progressing talks with potential major partners.

For PNS, the logic is simple: 3DICOM™ reduces waste, improves satisfaction for both patients and physicians and directly increases its share of healthcare savings. For SHG, it means credibility, revenue and a clear path to scale.

It’s still early. Execution, competition and funding remain watchpoints. But the alignment is rare: when partners invest, they’re not just buying a product – they’re buying into the growth story itself.

This article reflects information accurate as of 10 September 2025.

Superhero Markets Pty Ltd has a commercial arrangement with Singular Health Group (ABN 58 639 242 765) and investors should be aware this arrangement may influence the objectivity of the information presented. Superhero does not provide financial advice that considers your personal objectives, financial situation or particular needs. Singular Health Group’s products are offered independently and nothing included in the information presented should be considered an endorsement or guarantee of their products and services by Superhero.

As always, it is essential to conduct your own research and due diligence before making any investment decisions. Superhero does not provide financial advice that considers your personal objectives, financial situation or particular needs. All investments carry risk so please consider carefully before investing. Remember that past performance is not indicative of future performance. Graphics, charts and graphs provided for illustrative purposes only.

Become a part of

our investor community

Why you should join us:

- Join free and invest with no monthly account fees.

- Fund your account in real time with PayID.

- Get investing with brokerage from $2. Other fees may apply for U.S. shares.

Read our latest articles

Make knowledge your superpower and up your skills and know-how with our news, educational tools and resources.

![The top ASX lithium stocks by trade volume and performance [2023]](https://www.superhero.com.au/wp-content/uploads/2023/06/24-03_blog_news_toplithiumstocks_hero@2x-1024x796.jpg)